What is Mind Over Money?To post a message to all the list members, send email to mindovermoney_financial_literacy@listsstanfordedu You can subscribe to the list, or change your existing subscription, in the sections below Subscribing to mindovermoney_financial_literacy Subscribe to mindovermoney_financial_literacy by filling out the following formMind Over Money has designed several templates for different time frames monthly, quarterly, summer 3 Plan for the current you and the future you Assuming you are a student, you are likely spending money on tuition, housing, food, books, educational supplies, travel, and personal expenses like your phone bill and toiletries

Stanford University Admissions 21 Fees Acceptance Rate Entry Requirements Deadlines Applications Faqs

Mind over money stanford

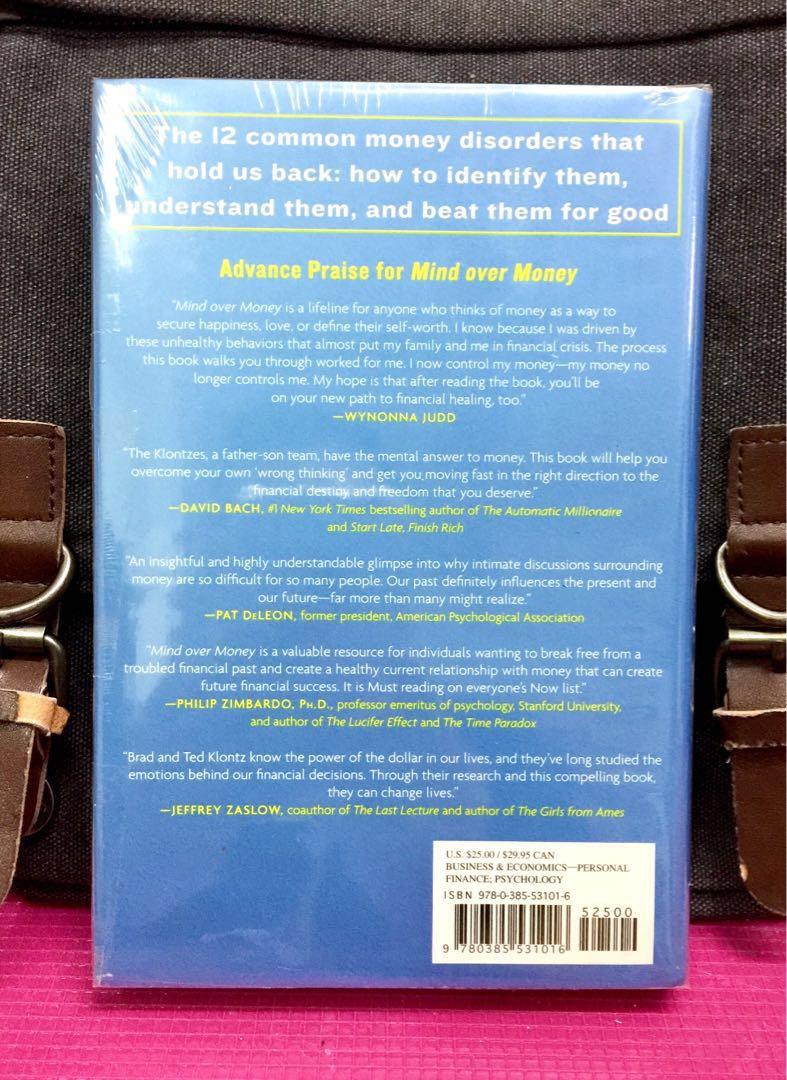

Mind over money stanford-Dec 29, 09Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,Mind Over Money, Stanford's financial wellness program, aims to provide all students with the knowledge, skills, and habits to be financially well during your time at Stanford, and beyond Any Stanford student or postdoc can meet oneonone with a Mind Over Money Financial Coach for free Most of the 50

Stanford Medicine Imaging And Express Care Stanford Health Care

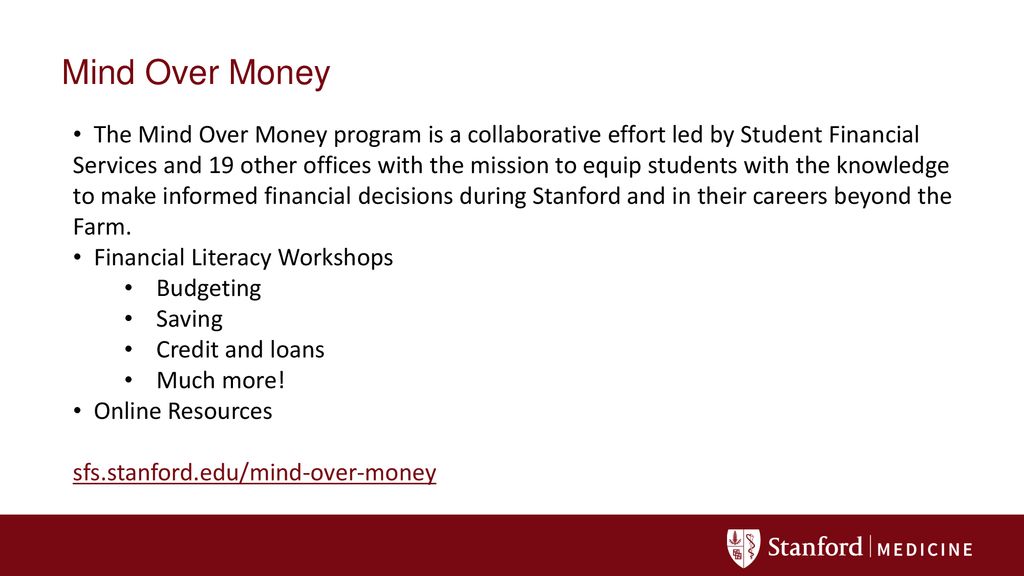

Mind Over Money equips students with the knowledge to make informed financial decisions during Stanford and in their careers beyond graduation Visit Mind Over Money at Stanford Mind Over Money is supported by the Charles Schwab Foundation, a nonprofit dedicated to financial education and empowerment The information presented on this site, including externalStudents should include their 1098T form from Stanford in their tax return if they are applying for the American Opportunity Credit or Lifetime Learning Credit Students should use their Account Activity data in Axess to determine their aid income and qualified expenses for each tax year (not the 1098T) Keep your W2 or 1099 from your employerFullTime Degree Programs MBA;

Feb 09, 18Mind Over Money, a program of Student Financial Services, is guided by a Leadership Advisory Board, which includes staff members from offices and programs across campus, including StanfordJul 11, 19After taking Mind Over Money's winter course, Financial Wellness 1, Stanford students Jorge AvelarLopez, ', and Rachel Hinds, ',Stanford Student Affairs runs Mind Over Money, a program with tools and resources for financial literacy Fellowships The NSF PreDoctoral Graduate Research Fellowship is a threeyear prestigious, nationallycompetitive (about 10% of applicants are successful) fellowship

Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,Thanks for your interest in the Associate Director, Mind Over Money Program position Stanford is an equal employment opportunity and affirmative action employer All qualified applicants will receive consideration for employment without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disabilityInvesting Overview Unread Value vs Growth

Boutique Hotels In San Francisco Stanford Court Hotel

5 Personal Finance Books That Will Change How You Think About Money

Workshop times can be found on Stanford's Mind Over Money website This workshop is only for US citizens, permanent residents, and those considered resident aliens for tax purposes To determine if you are a nonresident or resident alien for tax purposes, please see information hereMay th Mind Over Money X FLIP X FLI Office FLInancial Wellness Attend this financial wellness workshop hosted by Angela Amarillas, the Mind Over Money Associate Director, as well as the Firstgen, LowIncome Partnership (FLIP) and the Firstgen, LowIncome (FLI) Office!Connect with Mind Over Money for your financial wellness learning modules you can do on your own time, coaching, virtual events, and additional resources Practice a minute meditation or watch a webinar from the Stanford Medicine Health and Human Performance team

Stanford Mind Over Money Youtube

I Changed My Mind About Money Made More Instantly By Holly Stanford Brown Change Your Mind Change Your Life Medium

Program Associate Mind Over Money Stanford University The $100,000 prize money was used to implement renewable energy technologies at Waterford Kamhlaba UWCSA, such asModels and Methods For Behavior Change Support Our Work Search formThe Stanford community) and Mind Over Money (Stanford's financial wellness program for students) February 21 Start young, retire young!

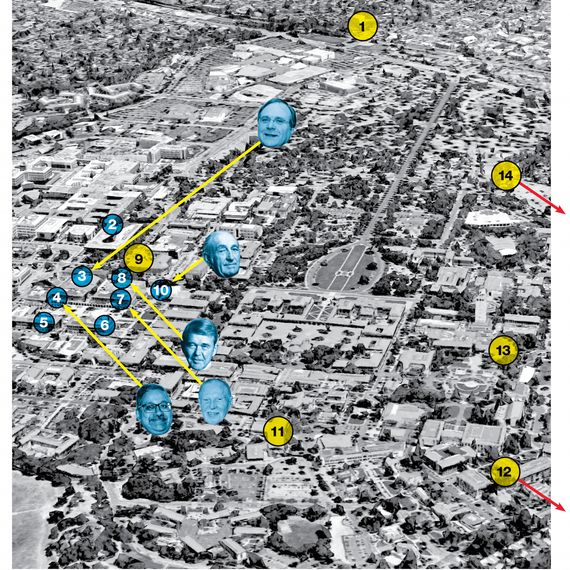

Who Gets In Stanford Magazine

Stanford University Admissions 21 Fees Acceptance Rate Entry Requirements Deadlines Applications Faqs

Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,Mind Over Money aims to serve as a campuswide resource to equip students with a foundation to make informed financial decisions during their time at Stanford and in their careers and lives after the Farm Mission To be an accessible program, integral to the Stanford community, that offers reliable tools, diverse resources,Budgeting Lucia Melgarejo Salvatierra, Stanford senior,

Stanford University Cost Options Edmit

How To Get Into Stanford By An Accepted Student

May 18, 218 NonDiscretionary Expenses (optional) If you have nondiscretionary expenses (eg, family health insurance, medical, dental, legal) outside the typical enrollmentrelated costs for the enrollment period, please itemize and explain below If you would like these amounts to be included in your eligibility for student loans, you must submit documentation of these expensesThe Stanford community) and Mind Over Money (Stanford's financial wellness program for students) May 21 Grad Special Edition!Stanford University About Stanford University undergraduate () studying HumanComputer Interaction in the department of Computer Science Mind Over Money

Scholarship Vs Prestige When To Take The Money And Run Lsat And Law School Admissions Blog

First Gen Low Income And Claiming A Community Stanford Magazine

Apr 23, 21Stanford, California Financial Aid Office at Stanford Universityone of the world's leading research and teaching institutions It is located in Palo Alto, CaliforniaI am leading and contributing to a variety of studentfocused efforts in Stanford's Mind Over Money financial wellness program, particularly by heightening students' awareness and increasing theMind Over Money Courses at Stanford 1019 Winter 19 1 unit WELLNESS 1 Financial Wellness for a Healthy Long Life (1unit) Utilize a practical, financial planning approach to financial wellness with integrated psychological research and theory in human behavior Explore critical personal finance concepts connected to long life and

Jon Park Md Frcsc Stanford Health Care

Difference Making College Financial Literacy Programs Lendedu

Mind Over Money's free 11 financial coaching program provides students with universitytrusted individuals with whom to share their personal financial circumstances, and the opportunity to explore ideas, concepts, and resources Find a Financial CoachThis week, we're introducing you to Mind Over Money , who aims to provide all students with the knowledge and skills to make healthy financial decisions during theirThe Mind Over Money program is the top rated university level student financial wellness program that seeks to provide students with the tools they need to be financially well throughout their life In our partnership with them, we are bringing tools and resources for studying the impact these programs have on behavior

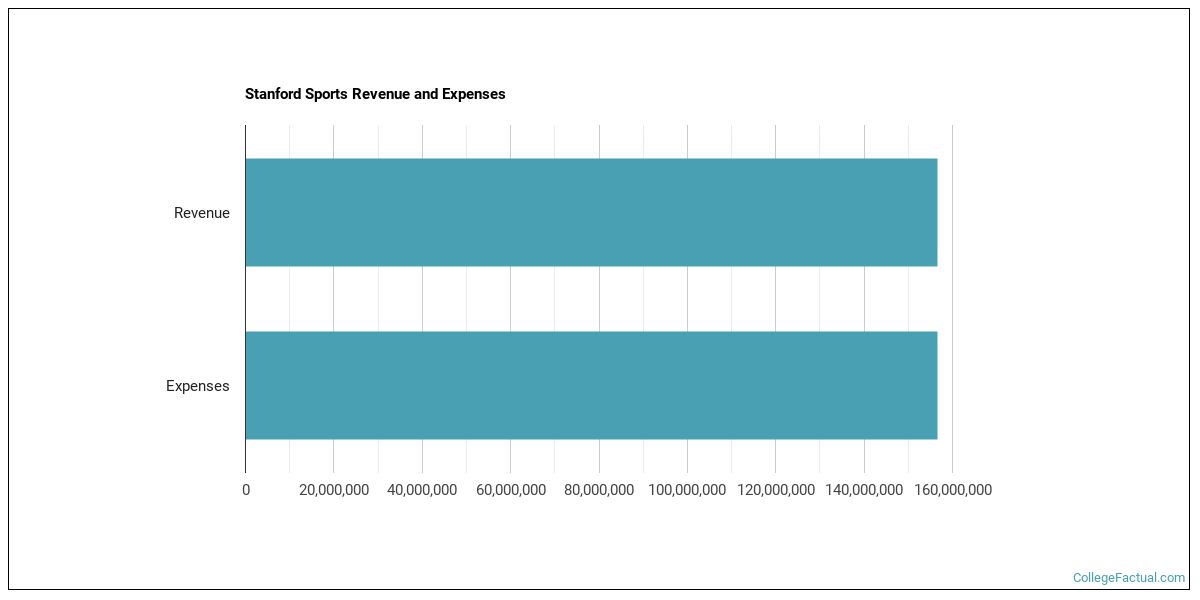

Stanford University Athletics Programs College Factual

Zm8lmiuh3zcqzm

"For a long time, I thought that we should have some way to deal with that," he said "There are bits and pieces of that all over Stanford now – like the financial wellness class, 'Mind over Money' — but I thought maybe we needed a more formal undergraduate course that was widely available" Fast forward to autumn 18Mind Over Money Financial Literacy Workshop Videos Set yourself up to make good financial decisions with advice from alumni!$0 $0,000 $400,000 $600,000 $800,000 $1,000,000 $1,0,000 $1,400,000 $1,600,000 1 2 3 THE COST OF WAITING Start contributing at age 35 Start contributing at age 25 Projected balance

Bran New Hardcover The 12 Common Money Disorders That Hold Us Back How To Identify Understand Beat Them Brad Klontz Ted Klontz Mind Over Money Overcoming The

Stanford University Athletics Programs College Factual

Mar 19, Mind Over Money's other resources for Stanford students include yearround personal finance workshops, budget templates and tips for managing debt Learn more on Mind Over Money's studentAt Stanford University, researchers stumble on a possible answer Their research, at first, has nothing to with money It isn't even being conducted by economists Mind Over Money WrittenSep 18, 19Saving at Stanford Mind Over Money When coming to college, for many students, you will have more freedom to make your own decisions than ever before—including financial ones!

Happy Headline 98 3 The Coast

A Closer Look At The Stanford Prison Experiment Video Khan Academy

Mind over Money Consulting Inc is a community partner recognized for delivering needed financial education and financial coaching opportunities to adults and youth The lack of financial literacyMind over money Stanford University students also have access to the Mind Over Money site which is part of the Student Affairs Office Part of the mission of Mind Over Money is to To foster a campus culture of financial awareness and understanding , encourage financially healthy behaviors , and help students build the skills and aptitude toBanks and Credit Unions Transportation Costs Insurance

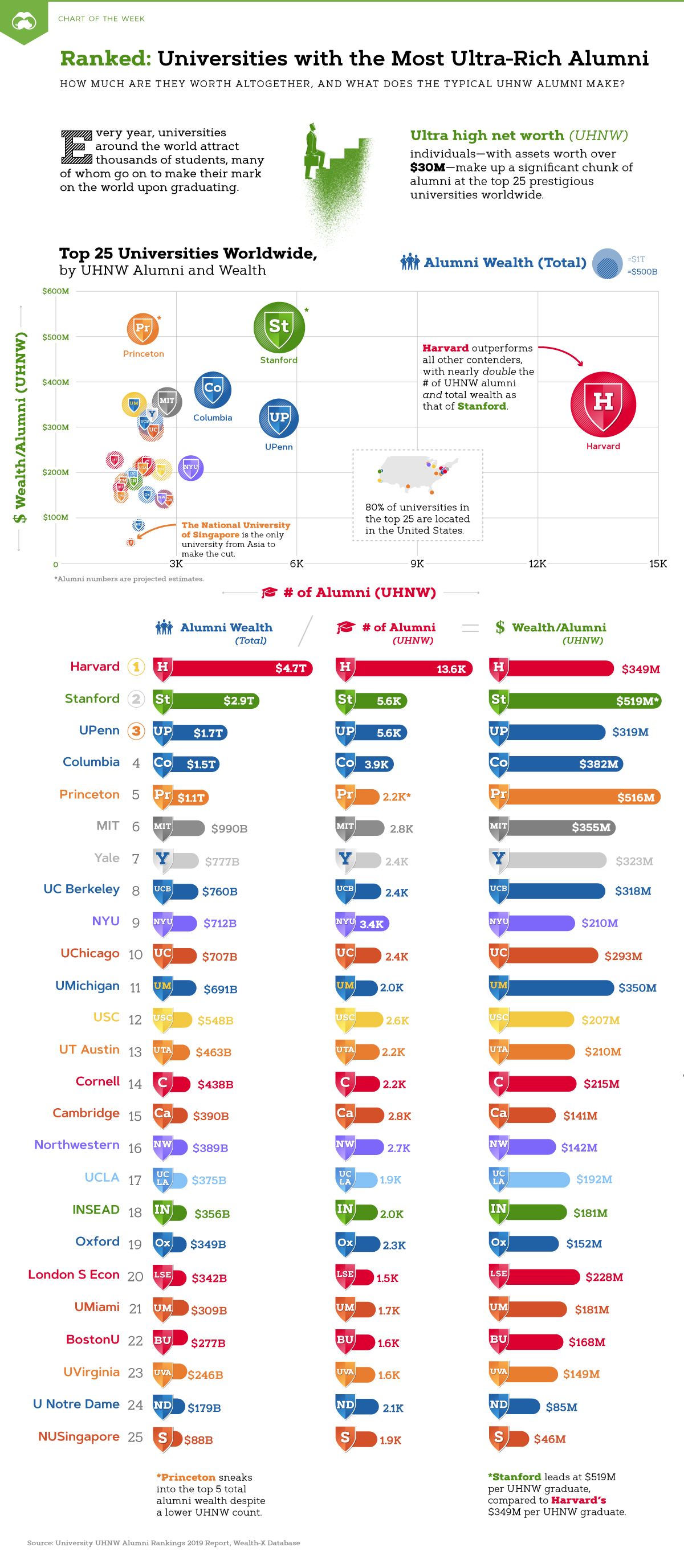

Chart Which Universities Have The Richest Graduates

Jual Mind Over Money Brad Klontz Di Lapak Honkz Bukalapak

Stanford Mind Over Money Stanford Bookstore Challenge Success The Stanford Humanities Center Wise Stanford Neurosurgery Stanford Health Care Careers Stanford University, Office of the Vice Provost for Graduate EducationVPGE Friends of the Palo Alto LibraryWith Stanford for 9 years, she is a Senior Financial Analyst with Student Financial Services and the Director of the Mind Over Money Program Prior to Stanford, she spent 13 years as a business lender with Union Bank, leaving her with a practical education inStanford Associates Alumni Honorary Organization Cornell University Cornell University Engineering 1975 1976 Piedmont High School Mind over Money Financial Literacy Coach

7 Must Listen Retirement Podcasts That Aren T About Money Kiplinger

How To Get Into Stanford By An Accepted Student

Richard L Peterson, Inside the Investor's Brain The Power of Mind over Money (Wiley 07) Richard Peterson is a medical doctor with a residency in psychiatry, and with postgraduate training in neuroeconomics from Stanford University He is a former stock trader, Associate Editor of The Journal of Behavioral Finance, a highlevel professionalMind over Money aims to serve as a campuswide resource to equip students with a foundation to make informed financial decisions during their time at Stanford and in their careers and lives after the Farm Students who apply for the Opportunity Fund may be required to complete financial literacy training in order to be approved for further grantsMarginal vs Effective Tax Rate Unread Effective Tax Rate Calculator

Recorded Workshops For Stanford Students Mind Over Money

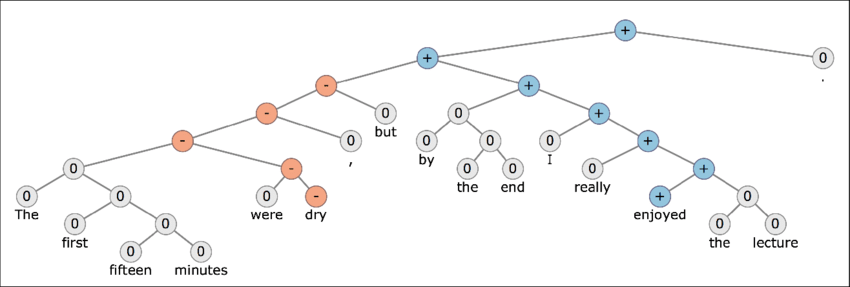

Sentiment Analisys In Hotel Reviews How To Build A Decision Making Assistant For Travelers Altexsoft

Mind Over Money is a Stanford program offering classes, coaches and many other resources to help students make informed decisions BEAM Career Education helps students explore job opportunities The Stanford FLI Office Opportunity Fund helps students who are experiencing an unexpected financial challenge or who are seeking funds for anAssociated Students of Stanford University (ASSU) Student Activity Fees Waiver Campus Health Service Fee 21 Health Insurance and Campus Health Service FeeIn this workshop, we will define what financial wellbeing means to you

Stanford Medicine Imaging And Express Care Stanford Health Care

Stanford Mind Over Money Added Stanford Mind Over Money

Stanford Mind Over Money 9 likes Education Website Facebook is showing information to help you better understand the purpose of a PageAs difficult as it may be to think about retirement when you're still in school, you should begin saving for retirement just as soon as you're able The younger you are when you start investing, the

Stanford Mind Over Money Photos Facebook

How To Network Your Way Through Stanford University

Stanford Prison Experiment Wikipedia

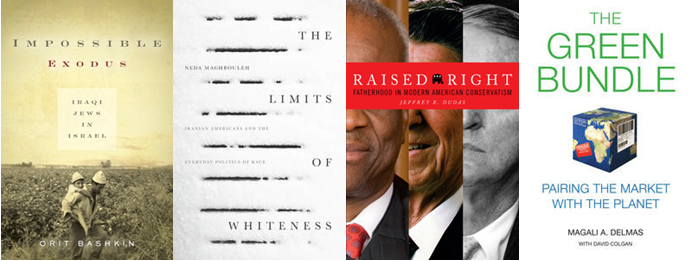

What Is The Point Of A University Press Times Higher Education The

Zoom Fatigue Brought Into Focus By Stanford Study Financial Times

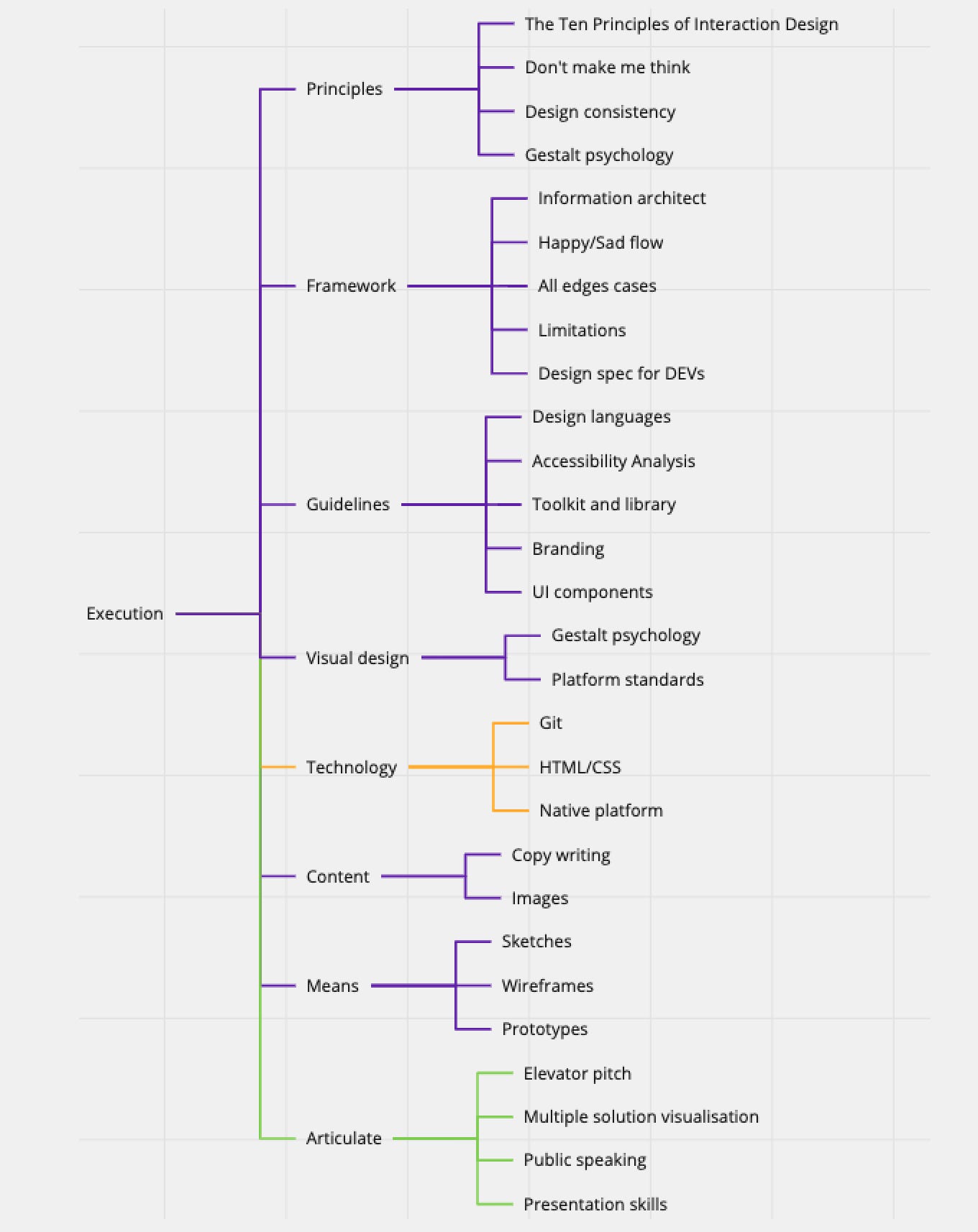

Ux Design Methods In A Mind Map When To Apply Which Design Method How By Mei Zhang Ux Planet

Mind Over Money Psychology Today

Mind Over Money Office Hours Student Financial Services

Mind Over Money

Chemwell Mind Over Money Workshop Mind Over Money

Local Parents Stanford Coach Indicted In College Admissions Scandal News Palo Alto Online

Life Changing Inspirational Quotes Popsugar Smart Living

The Bearer Of Good Coronavirus News Wsj

Here S The Letter Stanford S Golf Coach Used To Recruit Tiger Woods To The University Business Insider India

Inside The Investor S Brain The Power Of Mind Over Money Peterson Richard L Amazon Com Books

Stanford Mind Over Money Photos Facebook

Qiijcub0go0wum

Mind Over Money

The Stanford Empire Reveal

Financial Aid Entrance Counseling Session Wednesday September 18

I Changed My Mind About Money Made More Instantly By Holly Stanford Brown Change Your Mind Change Your Life Medium

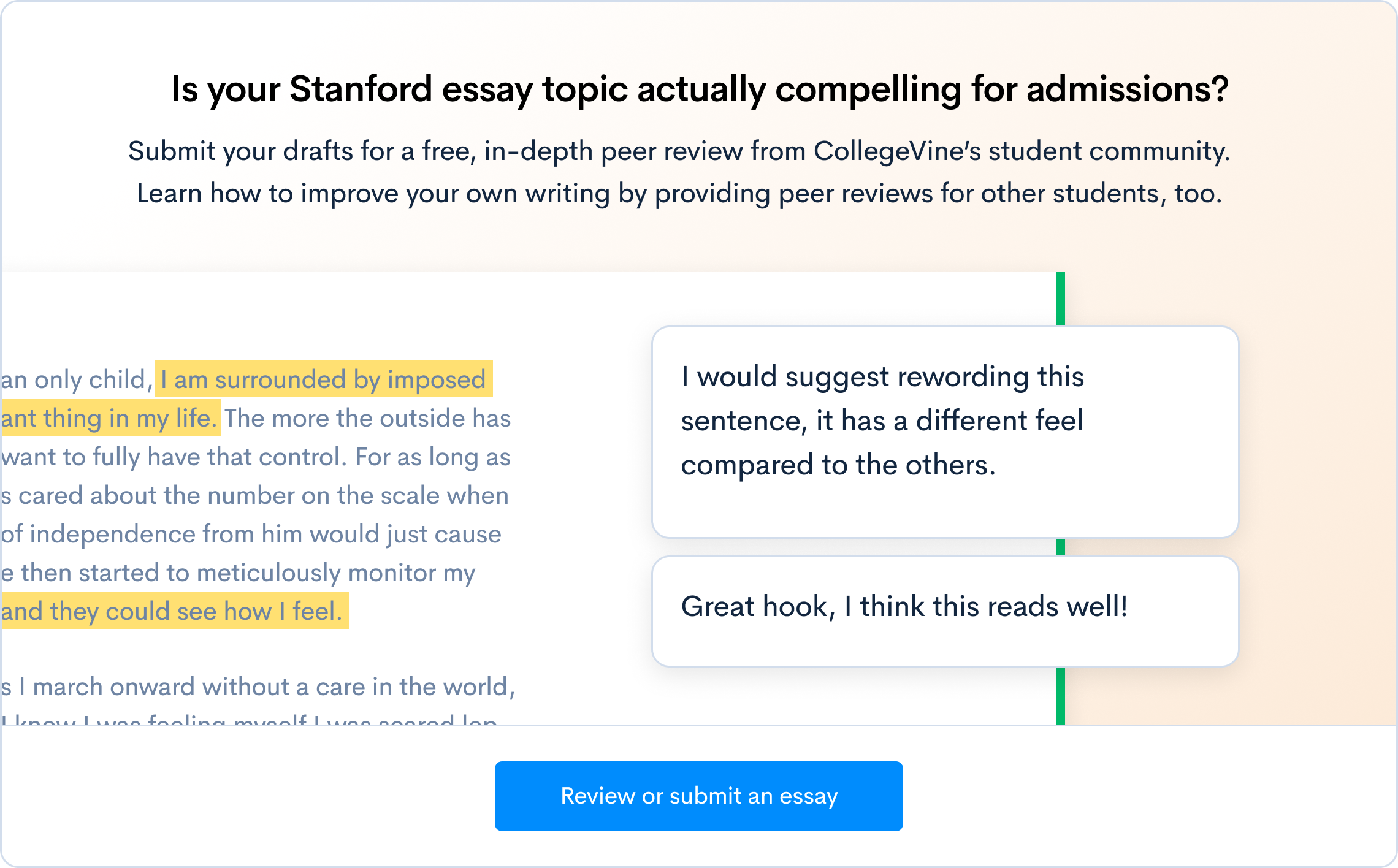

How To Write The Stanford Roommate Essay Examples

Stanford Moves To Stop Providing Funds To Its University Press

Stanford University Vpue Approaching Stanford Handbook 19 Page 58 59 Created With Publitas Com

Mind Over Money Capital One

Appealing To A College For More Financial Aid The New York Times

Mind Over Money How To Develop A Smarter Money Mindset

Stanford Moves To Stop Providing Funds To Its University Press

The Stanford Encyclopedia Of Philosophy Has Achieved What Wikipedia Can Only Dream Of Quartz

Mind Over Money Nova Pbs

Cb W4tp84g3xrm

A Tentative Checklist Of Questions To Ask When Analyzing A Government Program Abernethy 1978 Policy Studies Journal Wiley Online Library

Stanford University Students Flock To A Virtual Campus Innovation Smithsonian Magazine

Only Great Psychology Books Make It On To This Page

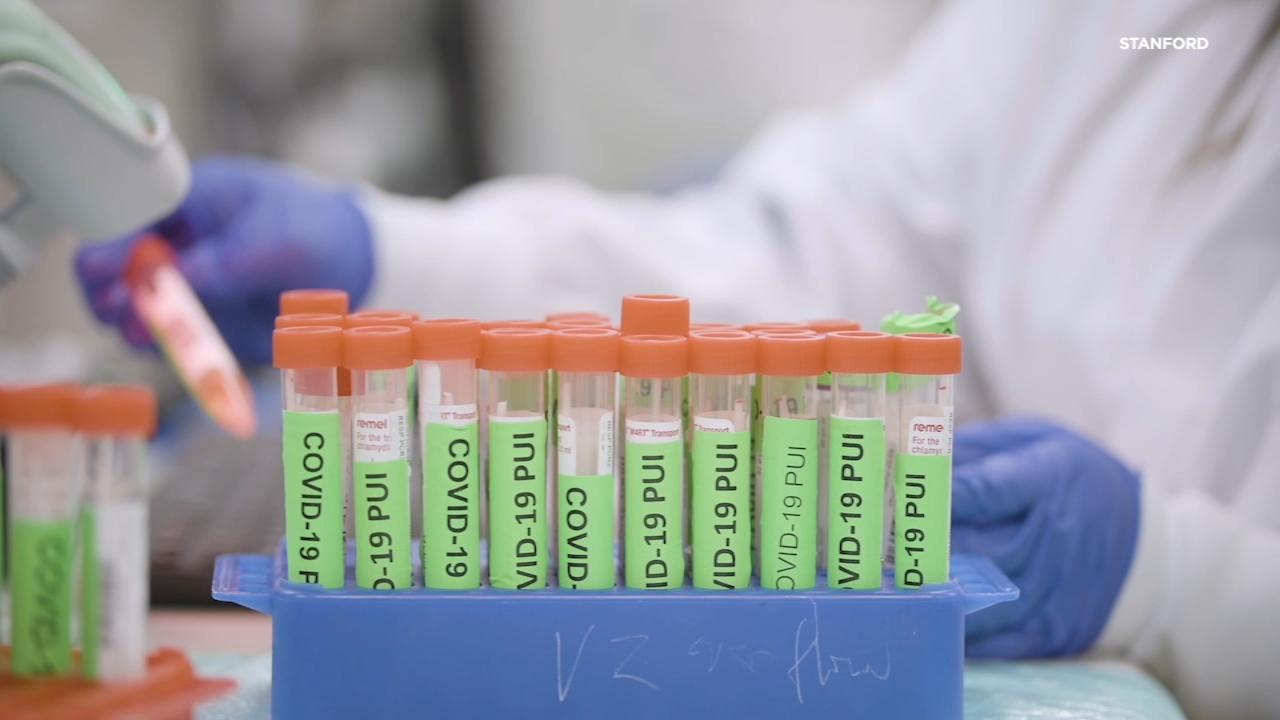

Stanford Tests New Vaccine That Could Be More Easily Distributed

Mind Over Money Overcoming The Money Disorders That Threaten Our Financial Health Klontz Brad Klontz Ted Amazon Com Books

Jvyzhar21mrkem

Ux Design Methods In A Mind Map When To Apply Which Design Method How By Mei Zhang Ux Planet

Stanford Flip Stanford Flip Twitter

Bran New Hardcover The 12 Common Money Disorders That Hold Us Back How To Identify Understand Beat Them Brad Klontz Ted Klontz Mind Over Money Overcoming The

Stanford Health Care Stanford Hospital In Stanford Ca Rankings Ratings Photos Us News Best Hospitals Rankings

How To Save More Money Npr

The Power Of Self Hypnosis Hypnosis Hypnotize Yourself American Medical Association

How To Network Your Way Through Stanford University

How To Write The Stanford University Essays 21 Collegevine

Is An Mba A Big Waste Of Time And Money Financial Samurai

/cdn.vox-cdn.com/uploads/chorus_asset/file/19577734/1172033932.jpg.jpg)

Inside Mind The Gap The Secretive Silicon Valley Group That Has Funneled Over Million To Democrats Vox

Mind Over Matter May Actually Work When It Comes To Health Study Finds

Mind Over Money The Psychologist

Stanford Mind Over Money Home Facebook

Stanford Student Invents Test To Detect Premature Birth Pre Eclampsia

Study Makes Claim That Masks Are Ineffective Have Devastating Health Consequences Outkick

D Shai Hendricks Analytics Manager Policygenius Inc Linkedin

Stanford S Mind Over Money Program Fosters Financial Literacy Stanford News

Mind Over Money

Poets Quants Why Power Is More Important Than Money

Stanford University Is Going To Invest In Student Startups Like A Vc Firm Techcrunch

Mind Over Money How To Develop A Smarter Money Mindset

Stanford24 Instagram Posts Gramho Com

Money Chat With Mind Over Money 6 2 Student Financial Services

Financial Basics For Entering Medical Students Ppt Download

Stanford University Is Going To Invest In Student Startups Like A Vc Firm Techcrunch

Everything You Ve Been Told About Money Is Wrong Youtube

Stanfordstudent Instagram Posts Photos And Videos Picuki Com

Mind Over Money Overcoming The Money Disorders That Threaten Our Financial Health Klontz Brad Klontz Ted Amazon Com Books

How To Write The Stanford University Essays 21 Collegevine

Financial Aid Entrance Counseling Session Wednesday September 18

The Stanford Alumnus Behind Netflix Documentary The Social Dilemma Wants You To Stop Scrolling News Almanac Online

Carolyn Parrs Ceo Founder Mind Over Markets Linkedin

Keep Stanford Wrestling Proves That All Colleges Care About Is Their Bottom Line Campus Times

0 件のコメント:

コメントを投稿